There are several major health insurance companies. These companies play a key role in the healthcare industry.

Health insurance is essential for managing medical expenses. It provides financial security during health crises. Many people wonder about the number of major health insurance companies. This question is crucial for those seeking the best coverage. The U. S. Health insurance market is vast and competitive.

It includes well-known names and regional providers. Understanding the major players can help you make informed choices. Whether you are picking a plan or comparing options, knowing the top companies is useful. In this blog post, we will explore the major health insurance companies and their roles in the industry. Stay tuned to gain insights into the leading health insurers.

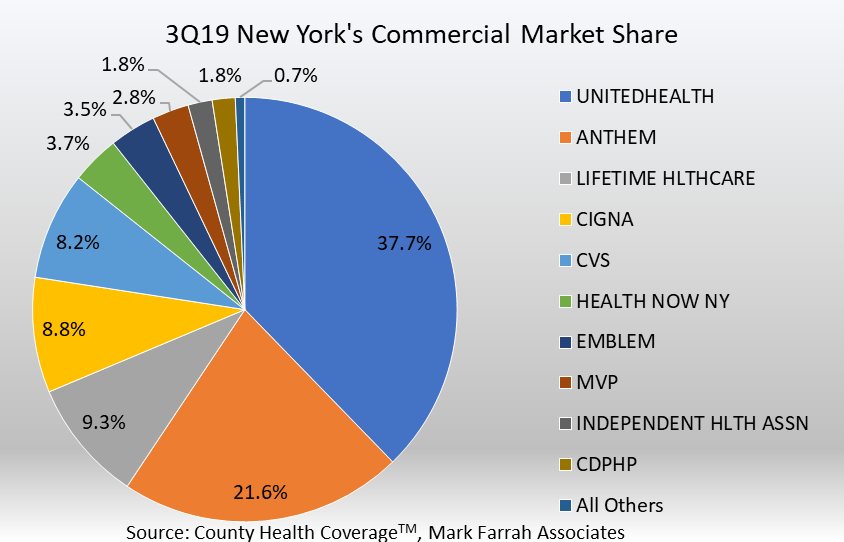

Credit: www.markfarrah.com

Top Health Insurance Companies

Choosing the right health insurance company can be overwhelming. There are many options, each offering unique benefits. In this section, we will explore some of the top health insurance companies in the United States. Understanding these major players will help you make an informed decision.

UnitedHealth Group is one of the largest health insurance companies. It provides comprehensive health plans. Their network covers a wide range of healthcare providers. They offer individual and family plans. UnitedHealth Group focuses on preventive care. This helps in reducing overall healthcare costs. They also provide digital tools for managing health.

Anthem is another leading health insurance company. It offers various plans across different states. Anthem is known for its customer service. They have a large network of doctors and hospitals. Anthem’s plans include wellness programs. These programs encourage healthy living. Anthem also offers telehealth services. This makes it easier to consult doctors remotely.

Aetna is a well-respected health insurance provider. It offers a range of health plans. Aetna focuses on personalized care. They have a strong network of healthcare providers. Aetna’s plans include preventive services. This helps in maintaining good health. They also offer health management tools. These tools assist in tracking health goals.

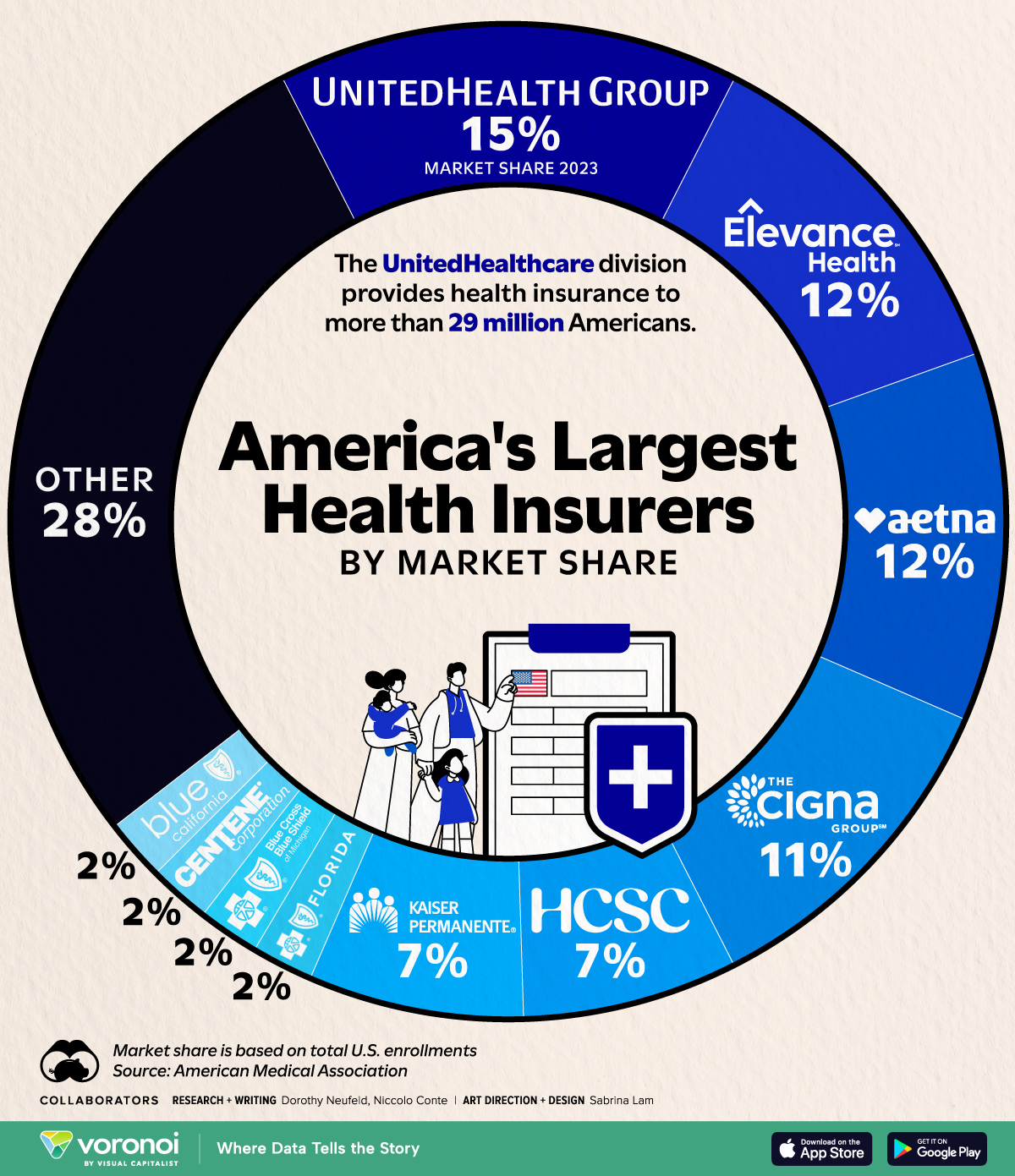

Credit: www.visualcapitalist.com

Unitedhealth Group

When it comes to choosing a health insurance provider, understanding the major players in the industry can make a significant difference. One of the leading names you’ll come across is the UnitedHealth Group. Let’s dive deeper into what makes this company a giant in the health insurance landscape.

Company Background

UnitedHealth Group, headquartered in Minnetonka, Minnesota, is one of the largest health insurers in the United States. Founded in 1977, the company has grown exponentially and now serves millions of members nationwide. With a commitment to improving healthcare quality and affordability, UnitedHealth Group stands out for its innovative approach and comprehensive services.

I remember when I first navigated the maze of health insurance options, UnitedHealth Group was one of the first names that popped up. Their extensive network and reputation made them a top choice for many.

Key Services

UnitedHealth Group offers a wide range of services that cater to different healthcare needs. Here are some of the key services:

- Individual and Family Plans: These plans offer comprehensive coverage, including preventive care, emergency services, and prescription drugs. You can find options that fit your budget and healthcare needs.

- Medicare Plans: For those eligible for Medicare, UnitedHealth Group provides various plans, including Medicare Advantage, Part D (prescription drug plans), and Medigap (supplemental insurance).

- Employer and Employee Plans: Businesses can choose from a range of group health insurance plans that provide robust coverage for employees. These plans often include wellness programs to keep your workforce healthy and productive.

- Medicaid Plans: UnitedHealth Group partners with state governments to offer Medicaid plans for low-income individuals and families. These plans ensure access to essential healthcare services.

These services demonstrate UnitedHealth Group’s dedication to accommodating the diverse needs of their members. Whether you’re looking for individual coverage or a comprehensive plan for your employees, UnitedHealth Group likely has an option for you.

Have you ever wondered how a health insurance company can impact your healthcare experience? UnitedHealth Group’s broad array of services and commitment to quality care might just be the answer you’re looking for.

Choosing the right health insurance provider is crucial, and understanding the offerings of major companies like UnitedHealth Group can help you make an informed decision. Stay tuned as we explore other leading health insurance companies in future posts!

Anthem

Anthem is one of the major health insurance companies in the United States. Known for its extensive network and wide range of services, Anthem plays a crucial role in the health insurance market. It caters to millions of members, offering various plans and services to meet diverse needs.

Company Background

Anthem, Inc. was founded in 1944. It is headquartered in Indianapolis, Indiana. The company has grown significantly over the decades. It now serves over 40 million Americans. Anthem operates under different brands in various states. These include Anthem Blue Cross and Blue Shield. The company’s mission focuses on improving lives and communities. Anthem aims to simplify healthcare and make it more affordable.

Key Services

Anthem offers a wide range of health insurance plans. These include individual and family plans. Also, Medicare and Medicaid plans. Employer-provided insurance is another key service. Anthem also provides dental and vision insurance. The company offers wellness programs to promote healthy living. Members can access telehealth services. This allows for virtual doctor visits. Anthem’s extensive network includes thousands of healthcare providers. This ensures members have access to necessary care.

Aetna

When it comes to selecting a health insurance provider, Aetna is a name that often comes up. But what sets this company apart from others? Let’s dive into Aetna’s background and key services to understand what makes it a significant player in the health insurance market.

Company Background

Aetna, founded in 1853, has a long history in the healthcare industry. Over the years, it has evolved from a life insurance company to one of the major health insurance providers in the United States. With its headquarters in Hartford, Connecticut, Aetna has expanded its reach through various mergers and acquisitions, including its notable acquisition by CVS Health in 2018.

Have you ever wondered why Aetna is such a trusted name in health insurance? It might be because of its commitment to improving the health and well-being of its members. Aetna achieves this by offering a wide range of plans tailored to meet different needs, from individuals to large employers.

Key Services

Aetna provides a variety of health insurance plans, ensuring there’s something for everyone. Whether you’re looking for individual plans, family plans, or employer-sponsored plans, Aetna has you covered. They also offer specialized plans such as Medicare Advantage and Medicaid services, making healthcare accessible to seniors and low-income families.

- Individual and Family Plans: These plans are designed to cater to the unique needs of individuals and families, offering comprehensive coverage options that include preventive care, prescription drugs, and emergency services.

- Employer-Sponsored Plans: Aetna offers flexible plans for businesses of all sizes, helping employers provide their employees with competitive health benefits.

- Medicare and Medicaid: For seniors and low-income individuals, Aetna offers Medicare Advantage plans and Medicaid services, ensuring they have access to necessary healthcare services without financial strain.

- Wellness Programs: Aetna goes beyond traditional health insurance by offering wellness programs aimed at improving the overall health of its members. These programs include resources for mental health, fitness, and chronic disease management.

One of the standout features of Aetna is its focus on preventive care. They believe that catching health issues early can lead to better outcomes and lower costs. This proactive approach is something you can benefit from, as it emphasizes regular check-ups and screenings.

Are you considering Aetna for your health insurance needs? Reflect on the comprehensive range of services they offer and how they align with your healthcare priorities. With Aetna, you’re not just getting an insurance plan; you’re partnering with a company committed to your long-term health and well-being.

Comparing Insurance Plans

Discover the variety of health insurance options available by comparing plans from several major companies. Understanding your choices can help you find the best coverage.

When it comes to choosing the right health insurance plan, the process can seem overwhelming. With numerous major health insurance companies offering various plans, how do you know which one is the best for you? By comparing insurance plans based on specific criteria like coverage options and cost, you can make a more informed decision. Let’s dive into the critical aspects you should consider when comparing health insurance plans.

Coverage Options

Different health insurance plans offer varied coverage options. Some plans might cover specific treatments, while others might not. For instance, you might find that one plan covers alternative therapies like acupuncture, whereas another does not. This level of detail can make a significant difference, especially if you have specific health needs. When I was comparing plans, I found that certain plans were more comprehensive in covering mental health services. This was a game-changer for me, as mental health support was a high priority. Ask yourself: What services are non-negotiable for your health and wellness? Knowing this will help you narrow down your choices.

Cost And Premiums

The cost of a health insurance plan is more than just the monthly premium. It’s essential to look at the total cost, including deductibles, co-pays, and out-of-pocket maximums. For example, a plan with a low premium might seem attractive at first glance. However, if it has a high deductible, you could end up paying more in the long run if you need significant medical care. When I switched my plan a few years ago, I chose one with a higher premium but lower deductible because I anticipated more frequent doctor visits. This saved me money overall. What are your health care needs and financial situation? Understanding both will help you find a plan that offers the best value for your money. Comparing health insurance plans isn’t just about picking the cheapest option. It’s about finding a balance between coverage and cost that fits your unique needs. By evaluating the coverage options and understanding the true cost of each plan, you can make a choice that supports your health and your wallet. So, what matters most to you in a health insurance plan? Coverage for specific treatments, or managing your monthly expenses? Take the time to compare and choose wisely.

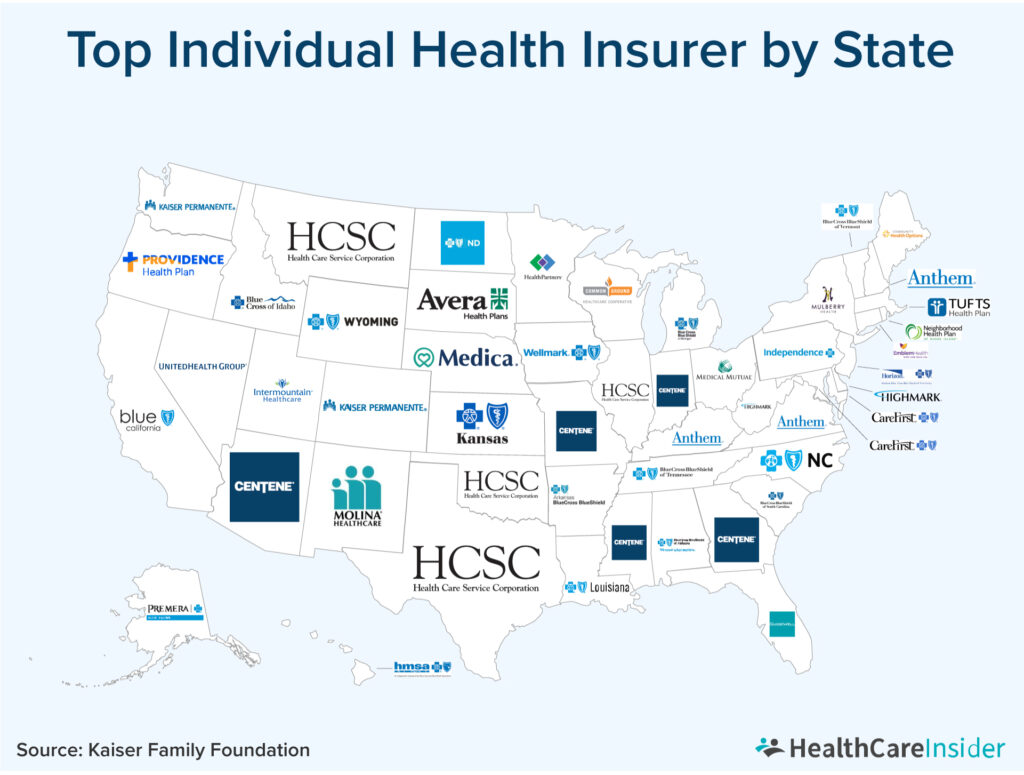

Credit: healthcareinsider.com

Choosing The Right Plan

Choosing the right health insurance plan can feel like navigating a maze. With so many options available from major health insurance companies, it’s essential to find the one that fits your unique needs. This is where the journey gets personal and sometimes, a bit overwhelming. But don’t worry, breaking down the process into manageable steps can make it much easier. Let’s dive into the key areas you should focus on when choosing the right plan for you.

Assessing Your Needs

The first step in choosing a health insurance plan is to assess your own needs. Start by asking yourself some important questions:

- Do you have any pre-existing conditions that require regular treatment?

- How often do you visit the doctor?

- Do you need coverage for prescription medications?

- Are you planning any major medical procedures in the near future?

- Do you have a preferred doctor or hospital?

Understanding your specific healthcare needs is crucial. It helps you narrow down your options and focus on plans that offer the necessary coverage. For instance, if you rarely visit the doctor, a plan with higher co-pays but lower monthly premiums might be more cost-effective for you. Conversely, if you have a chronic condition requiring regular care, you may want a plan with higher premiums but lower out-of-pocket costs.

Evaluating Providers

Once you have a clear picture of your needs, it’s time to evaluate the providers. Not all health insurance companies are created equal. Here are some factors to consider:

- Network: Check if your preferred doctors and hospitals are in the provider’s network. Out-of-network care can be significantly more expensive.

- Customer Service: Read reviews and ask around to see how the provider handles customer service. You want a company that is responsive and helpful.

- Financial Stability: Research the company’s financial health. A financially stable company is more likely to cover your claims without issues.

- Additional Benefits: Look for any extra perks the plan offers, such as wellness programs, telehealth services, or discounts on gym memberships.

When evaluating providers, think about your past experiences with health insurance. Have you ever had a claim denied? How long did it take to resolve the issue? These experiences can guide you in choosing a provider that will meet your expectations.

Choosing the right health insurance plan is not a decision to take lightly. Assess your needs carefully and evaluate providers thoroughly to ensure you select a plan that offers the coverage you need at a price you can afford. Take your time, do your research, and don’t hesitate to ask questions. Your health is worth it.

Future Of Health Insurance

There are several major health insurance companies. They play a big role in the future of health coverage. Understanding their impact can help people make better choices.

The future of health insurance is an intriguing topic that affects all of us. With rapid advancements in technology and ongoing policy changes, the landscape of health insurance is evolving at an unprecedented pace. How will these changes impact you and your family? Let’s delve into the future of health insurance to find out.

Technological Advances

Technology is revolutionizing the health insurance industry. Imagine having real-time access to your health records from your smartphone. Digital health platforms are making this possible. They allow you to manage your health more proactively. Wearable devices like smartwatches can monitor your vital signs and alert you and your healthcare provider of any anomalies. This data can be invaluable in tailoring your health insurance plans to your specific needs. Telemedicine is another technological advance transforming health insurance. You no longer need to take a day off work to visit a doctor. Virtual consultations are becoming more common, saving you time and reducing costs for insurance providers. Have you ever had a minor health issue but delayed seeing a doctor due to inconvenience? Telemedicine can solve that problem, making healthcare more accessible and efficient.

Policy Changes

Policy changes are equally significant in shaping the future of health insurance. Governments and regulatory bodies are continuously updating health policies to improve access and affordability. These changes can have a direct impact on your premiums, coverage options, and out-of-pocket expenses. One major shift is the move towards value-based care. Unlike traditional models that focus on the quantity of services provided, value-based care emphasizes the quality of care. This means insurance companies are increasingly incentivizing healthcare providers to focus on patient outcomes. How will this benefit you? Better health outcomes and potentially lower costs. Another critical policy change is the expansion of mental health coverage. Mental health issues have long been stigmatized and underinsured. Recent policy changes are making mental health services more accessible and affordable. This is a significant step forward, considering the importance of mental well-being in overall health. What do you think about these technological and policy changes? Are you prepared for the future of health insurance? These advancements promise a more efficient, personalized, and accessible healthcare system. Stay informed and proactive to make the most of these evolving opportunities.

Frequently Asked Questions

How Many Health Insurance Companies Are There?

There are over 900 health insurance companies in the United States. This includes both large and small providers.

What Are The Five Largest Health Insurance Companies?

The five largest health insurance companies are UnitedHealth Group, Anthem, Aetna, Cigna, and Humana.

What Are The Top 3 Health Insurances In The Usa?

The top 3 health insurances in the USA are UnitedHealthcare, Blue Cross Blue Shield, and Kaiser Permanente. They offer extensive coverage and quality services.

How Many Main Types Of Health Insurance Are There?

There are two main types of health insurance: private and public. Private insurance is purchased by individuals or employers. Public insurance is provided by the government, such as Medicaid and Medicare.

Conclusion

Major health insurance companies play a crucial role in healthcare. They offer various plans, helping people manage medical expenses. Understanding the number and types of these companies helps in choosing the right plan. Always research and compare options to find the best fit.

Knowing more about major insurers ensures better decisions for health coverage. Stay informed and make choices that benefit you and your family. Health insurance is essential for financial security and peace of mind. Make sure to explore all available options and select the best one for your needs.