A high deductible health plan (HDHP) has a higher out-of-pocket cost before insurance coverage begins. You might wonder if your health plan qualifies as HDHP.

Understanding your health insurance can be confusing. Health plans vary greatly, and knowing whether you have a high deductible plan is crucial. High deductible plans often mean lower monthly premiums but higher initial costs when you need care. These plans can be beneficial for certain individuals, especially those who don’t visit the doctor often.

Recognizing if your plan fits this category helps in managing your healthcare budget. We’ll explain the characteristics of high deductible plans and how to identify them. By the end, you’ll have a clearer picture of your insurance plan and its implications.

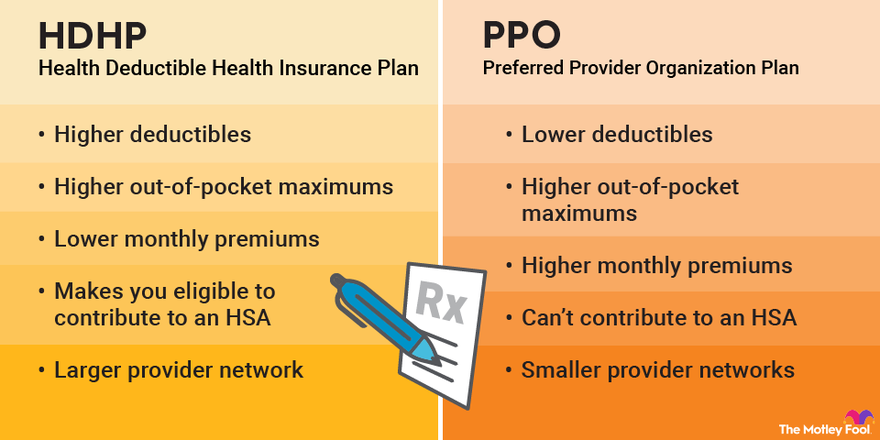

Credit: www.fool.com

What Is A High Deductible Plan

Understanding your health insurance can be confusing. One key aspect you need to know is whether you have a High Deductible Health Plan (HDHP). This information is crucial, especially if you are considering opening a Health Savings Account (HSA) or planning your medical expenses for the year. So, let’s dive into what a High Deductible Plan is and how you can recognize one.

Definition

A High Deductible Health Plan (HDHP) is a type of health insurance plan that requires you to pay higher out-of-pocket costs before your insurance starts covering your medical expenses. Unlike traditional health plans with lower deductibles, an HDHP often comes with lower monthly premiums. This setup means you pay less upfront each month, but you will have to cover more expenses yourself before your insurance kicks in.

Key Characteristics

To determine if you have an HDHP, look for these key characteristics:

- Higher Deductibles: As the name suggests, the most defining feature is the deductible amount. For 2023, the IRS defines an HDHP as any plan with a deductible of at least $1,500 for an individual or $3,000 for a family.

- Out-of-Pocket Maximums: HDHPs also have higher out-of-pocket maximums. In 2023, this limit is $7,500 for an individual and $15,000 for a family. This is the most you will pay during a policy period (usually a year) before your insurance covers 100% of your medical expenses.

- Eligibility for HSA: HDHPs make you eligible to contribute to a Health Savings Account (HSA). HSAs offer tax advantages and can be used to pay for qualified medical expenses. If your plan qualifies for an HSA, it’s a good indicator that you have an HDHP.

Have you ever noticed that your monthly premiums are lower than what your friends are paying for their health insurance? Or perhaps you’ve had a surprise medical expense and found yourself paying more out-of-pocket than expected? These are tell-tale signs that you might have an HDHP.

Think about your own experience with medical bills. Have you found yourself paying a significant amount before your insurance starts to cover your medical costs? That’s a clear indicator of an HDHP.

Now that you know the basic characteristics, take a closer look at your plan. Does it fit the criteria? If you’re still unsure, consider reaching out to your insurance provider for clarification.

Knowing whether you have a High Deductible Plan can help you make more informed decisions about your healthcare and finances. So, take the time to understand your plan thoroughly. Your wallet will thank you later.

Credit: www.youtube.com

Comparing Deductibles

When it comes to understanding your health insurance plan, one of the most crucial aspects is the deductible. Comparing deductibles can help you determine whether you have a high deductible plan or not. Understanding the difference between low and high deductibles, as well as how they impact your coverage, is essential. Let’s dive into the details.

Low Vs High Deductible

A deductible is the amount you pay out-of-pocket for healthcare services before your insurance starts to pay. It’s important to know whether you have a low or high deductible plan because it can significantly affect your healthcare costs and coverage.

Low deductible plans usually mean you pay less upfront for medical services. For instance, if your deductible is $500, you’ll start getting insurance benefits sooner. However, these plans often come with higher monthly premiums. You pay more each month, but your out-of-pocket costs when you need care are lower.

On the other hand, high deductible plans typically have lower monthly premiums. You save money each month, but you’ll pay more out-of-pocket before your insurance kicks in. For example, if your deductible is $1,500, you’ll have to cover that amount before your insurance starts to help with the bills.

Impacts On Coverage

The type of deductible you have can also impact the coverage you receive. With a low deductible plan, you might find it easier to access healthcare services without worrying about high costs right away. This can be particularly beneficial if you have regular medical needs, such as ongoing treatments or frequent doctor visits.

Conversely, high deductible plans might make you think twice before seeking medical attention. If you’re generally healthy and don’t require frequent medical care, this plan might save you money in the long run. However, if an unexpected medical issue arises, the high deductible could become a financial burden.

Consider your healthcare needs and financial situation carefully. Ask yourself, are you willing to pay higher premiums for the peace of mind that comes with lower out-of-pocket costs? Or would you prefer to save on monthly premiums, knowing you might face higher costs in case of a medical event?

Remember, the choice between low and high deductible plans isn’t just about money. It’s about how you want to manage your healthcare needs and expenses. By understanding these impacts, you can make a more informed decision that suits your lifestyle and budget.

Ultimately, knowing whether you have a high deductible plan involves a bit of homework. Review your policy documents, compare the numbers, and consider your personal healthcare needs. This way, you’ll be better prepared to handle whatever comes your way.

Identifying Your Plan

Understanding your health insurance plan is crucial. It helps in managing medical costs. One important aspect is knowing if you have a high deductible plan. High deductible plans require you to pay more out of pocket before the insurance starts paying. But how do you identify your plan? Let’s break it down.

Reviewing Your Policy

The first step is to review your policy documents. These documents contain details about your deductible. Look for the section that talks about deductibles. If the amount is high, you likely have a high deductible plan.

Pay close attention to the figures mentioned. A deductible over $1,400 for individual coverage is considered high. For family coverage, a deductible over $2,800 is high. Compare these numbers with what’s in your policy.

Contacting Your Provider

If the documents are confusing, contact your insurance provider. They can explain your plan in simple terms. Ask them directly about your deductible amount. They can provide clear answers.

Most providers have customer service lines. Use these to get the information you need. They can also send you a summary of your plan. This summary can help you understand your deductible and other important details.

Financial Implications

A high deductible plan usually has lower monthly premiums but higher out-of-pocket costs. Check your insurance details for the deductible amount. Plans with a deductible above $1,500 for individuals or $3,000 for families are considered high deductible.

When evaluating your health insurance options, understanding the financial implications of a high deductible plan is crucial. High deductible health plans (HDHPs) come with both advantages and disadvantages that can significantly affect your finances. Let’s delve into these financial aspects to help you make an informed decision.

Out-of-pocket Costs

One of the primary financial implications of a high deductible plan is the out-of-pocket costs. With an HDHP, you are responsible for a larger portion of your medical expenses before your insurance kicks in. This means you might need to pay several thousand dollars upfront for doctor visits, medications, and treatments. Imagine you need an unexpected surgery that costs $5,000. If your deductible is $3,000, you must cover that amount before your insurance helps out. Post-deductible, you might still be responsible for a percentage of the costs, like 20%, until you reach your out-of-pocket maximum. This can be financially challenging if you’re unprepared for such expenses.

Savings Potential

Despite the higher out-of-pocket costs, HDHPs also offer significant savings potential. These plans typically come with lower monthly premiums, which can save you money every month. If you’re generally healthy and don’t often require medical care, the savings on premiums can add up over time. Moreover, HDHPs are often paired with Health Savings Accounts (HSAs). HSAs allow you to save pre-tax money for medical expenses, which can further reduce your overall healthcare costs. You can use the money in your HSA to pay for deductibles, copayments, and other qualified medical expenses. The funds roll over year to year, and the account earns interest, making it a smart long-term saving strategy. Consider this: If you put $2,000 into your HSA each year and don’t need significant medical care, you can build a substantial safety net for future healthcare costs. ### Thought-Provoking Question Are you prepared to handle high out-of-pocket costs in exchange for lower premiums and potential tax savings? When evaluating whether an HDHP is right for you, it’s essential to weigh these financial implications against your health needs and financial situation. By understanding both the out-of-pocket costs and the savings potential, you can make a choice that aligns with your budget and health priorities.

Health Savings Accounts

When it comes to managing healthcare expenses, Health Savings Accounts (HSAs) can be a game-changer. If you have a high deductible health plan (HDHP), an HSA allows you to save money for medical expenses, tax-free. But how do you know if you qualify for an HSA and what benefits does it offer? Let’s dive into the specifics.

Eligibility

To open an HSA, you must meet certain criteria. First and foremost, you need to be enrolled in a high deductible health plan (HDHP). What qualifies as an HDHP? Typically, it’s a plan with a higher annual deductible and out-of-pocket maximums compared to other health plans.

Here’s a quick checklist to see if you’re eligible:

- You are enrolled in an HDHP.

- You have no other health coverage (exceptions include dental, vision, disability, and long-term care).

- You are not enrolled in Medicare.

- You cannot be claimed as a dependent on someone else’s tax return.

If you meet these criteria, you’re in luck! You can open an HSA and start enjoying its benefits.

Benefits

HSAs come with a range of benefits that can help you manage your healthcare costs more effectively:

- Tax Advantages: Contributions to your HSA are tax-deductible, reducing your taxable income. The money in your HSA grows tax-free, and withdrawals for qualified medical expenses are also tax-free.

- Flexibility: Unlike Flexible Spending Accounts (FSAs), HSAs are not “use it or lose it.” The funds roll over from year to year, allowing you to build a substantial healthcare nest egg.

- Portability: Your HSA stays with you regardless of changes in employment or health plans. It’s your account, and you can take it with you wherever you go.

- Investment Opportunities: Many HSAs offer investment options, similar to a 401(k), allowing your money to grow over time. This can be particularly beneficial if you don’t need to use the funds immediately.

Imagine you’re saving for a vacation, but an unexpected medical expense comes up. With an HSA, you have the funds available without the stress of figuring out where to get the money. It’s a financial cushion that provides peace of mind.

Are you maximizing your healthcare savings with an HSA? If you have an HDHP, it’s worth considering. The tax benefits alone make it a valuable tool, but the flexibility and investment opportunities add even more value. Take control of your healthcare expenses today and see how an HSA can benefit you.

Credit: www.ramseysolutions.com

Common Misconceptions

When it comes to understanding health insurance, one of the most confusing aspects is determining whether you have a high deductible plan. Many people find themselves unsure because of common misconceptions. Let’s dive into some of these misunderstandings and clarify what a high deductible plan really entails.

Misunderstood Terms

One of the biggest hurdles in understanding your health insurance is grappling with misunderstood terms. Many people confuse the deductible with the premium or co-payment.

For instance, the deductible is the amount you pay out-of-pocket before your insurance starts covering costs. This is not the same as your premium, which is the regular payment you make to keep your insurance active.

Additionally, a co-payment is a fixed amount you pay for a specific service, like visiting a doctor, which is different from your deductible. Knowing these distinctions can help you better understand your plan.

Clarifications

To determine if you have a high deductible plan, you need to look at specific figures. As of 2023, the IRS defines a high deductible health plan (HDHP) as one with a deductible of at least $1,500 for an individual or $3,000 for a family.

But it’s not just about the deductible amount. HDHPs are often paired with Health Savings Accounts (HSAs), which provide tax advantages. If your plan includes an HSA, it’s a strong indicator that you have an HDHP.

Consider your personal experience: Have you had to pay a significant amount before your insurance kicked in? Do you contribute to an HSA? These can be practical clues.

It’s crucial to review your policy documents carefully. Look for terms like “minimum deductible” or “HSA eligibility.” These details can help you identify if you’re dealing with an HDHP.

Ask yourself: Do you understand all the terms in your policy? Do you know the exact amount of your deductible? Clarity on these points can save you from unexpected financial surprises and help you make informed healthcare decisions.

By addressing these common misconceptions and clarifying key terms, you can confidently determine whether you have a high deductible plan. Take control of your health insurance knowledge and ensure you’re making the best choices for your financial and healthcare needs.

Decision Making

When it comes to selecting a health insurance plan, decision making can be daunting, especially if you’re trying to determine whether you have a high deductible plan. Understanding the nuances of your plan is crucial for making informed choices about your healthcare. Let’s break down the key points to consider.

Evaluating Your Needs

First, you need to evaluate your needs. Ask yourself some essential questions: Do you frequently visit the doctor or require regular medication? Are you managing a chronic condition, or are you generally healthy?

If you anticipate needing frequent medical care, a high deductible plan might result in higher out-of-pocket costs. On the other hand, if you’re healthy and rarely need medical services, you could save money on premiums with a high deductible plan.

Imagine you rarely visit the doctor but suddenly require surgery. With a high deductible plan, you would need to pay a significant amount before your insurance kicks in. It’s a trade-off between lower monthly premiums and potentially higher emergency costs.

Long-term Considerations

When deciding on a high deductible plan, think about the long-term implications. Will your financial situation allow you to cover the high deductible if an unexpected medical expense arises? Consider setting aside money in a Health Savings Account (HSA) if your plan is HSA-eligible. HSAs offer tax advantages and can help cover the deductible.

Reflect on your future healthcare needs. If you plan to start a family or anticipate a major life change, a high deductible plan might not be the best choice. Planning ahead can save you from financial stress.

What about preventative care? High deductible plans often cover preventative services at no cost. If you’re proactive about your health, this could be an advantage.

Ultimately, choosing a health plan requires balancing your current needs with future possibilities. Take the time to understand your health, financial situation, and risk tolerance. This will empower you to make the best decision for your circumstances.

Have you ever faced a hefty medical bill that made you question your insurance plan? Share your experiences and insights in the comments below. Your story could help others navigate their decision-making process!

Next Steps

Verify your insurance documents to see if your deductible exceeds $1,400 for individuals or $2,800 for families. Contact your insurance provider for detailed information.

Next Steps After determining whether you have a high deductible health plan (HDHP), you might be wondering what to do next. Knowing your plan type is just the beginning. The following steps can help you make informed decisions about your healthcare coverage and ensure you’re getting the most out of your plan.

Plan Adjustments

Once you know you have an HDHP, consider reviewing the specific details of your plan. Look at the deductible amount, out-of-pocket maximum, and covered services. This can help you budget for potential healthcare expenses. Consider adjusting your Health Savings Account (HSA) contributions if you have one. An HSA can help you save money for medical expenses tax-free. Increasing your contributions can provide a financial cushion for unexpected medical costs. If you find that your HDHP isn’t meeting your needs, you might want to look into different plan options during the next enrollment period. Compare the pros and cons of other plans to see if there’s a better fit for your situation.

Seeking Advice

Feeling overwhelmed by the details? You’re not alone. It can be helpful to seek advice from professionals. Speak with your company’s HR department or a health insurance broker. They can clarify plan specifics and help you understand your options. You can also talk to a financial advisor. They can provide insights into how your health plan fits into your broader financial picture and suggest strategies for managing healthcare costs. Have you ever considered reaching out to friends or family who might have similar plans? They can share their experiences and tips for managing an HDHP effectively. Taking these steps can lead to a better understanding of your health plan and how to use it wisely. What changes will you make to maximize your benefits and protect your financial health?

Frequently Asked Questions

How Do I Know If My Plan Is High Deductible?

Check your insurance policy details. A high deductible plan usually has a minimum deductible of $1,400 for individuals or $2,800 for families.

How Do I Find Out If My Health Plan Is Hsa-eligible?

Check if your health plan is HSA-eligible by reviewing the plan documents or contacting your insurance provider directly. Make sure it has a high deductible and meets IRS requirements.

Is $3,000 A High Deductible For Health Insurance?

Yes, $3,000 is considered a high deductible for health insurance. High deductibles can lead to lower monthly premiums.

Is Ppo Considered Hdhp?

No, a PPO is not considered an HDHP. A PPO is a Preferred Provider Organization, while an HDHP is a High Deductible Health Plan.

Conclusion

Understanding your health insurance plan is crucial. High deductible plans often mean lower premiums. Check your plan’s details for deductible amounts. Compare with standard deductible thresholds. Confirm with your insurance provider if unsure. Knowing your plan helps manage healthcare costs.

Stay informed and make the best choices for your health and finances. Always review your plan annually. Changes can occur, and staying updated is important. Making informed decisions leads to better health and financial stability.