Finding the best health insurance can be challenging. There are many options out there.

Which one is the best? Health insurance is essential for everyone. It covers medical costs and provides peace of mind. But with so many choices, picking the right one can be tough. Some plans offer extensive coverage, while others are more basic.

Factors like cost, network of doctors, and coverage specifics play a big role. In this blog, we’ll break down what makes a health insurance plan the best. We’ll consider different needs and budgets. Stay with us as we explore the top health insurance options on the market. You’ll be better equipped to make an informed decision. Let’s dive in.

Introduction To Health Insurance

Health insurance is a contract between you and an insurance company. It helps cover medical costs for illness, injury, and preventive care. This coverage can save you from expensive medical bills. Without it, even a minor health issue can lead to financial strain.

Importance Of Health Insurance

Health insurance is crucial for several reasons. First, it provides financial protection in case of major health issues. Unexpected medical events can happen to anyone. Having coverage ensures you get the care you need without a massive financial burden.

Second, insurance often covers preventive services. These include vaccinations and screenings, which keep you healthy. Regular check-ups can detect issues early, making treatment easier and more effective. This proactive care can lead to better long-term health outcomes.

Finally, health insurance provides peace of mind. Knowing you are covered in case of emergencies reduces stress. This security allows you to focus on recovery, not on how to pay for it.

Factors To Consider

Choosing the best health insurance involves several factors. First, consider the coverage options. Different plans cover different services. Make sure the plan fits your medical needs.

Second, look at the cost. This includes premiums, deductibles, and co-pays. Ensure you can afford these expenses. Sometimes a higher premium means lower out-of-pocket costs. Balance what you pay monthly with what you might pay during a medical event.

Third, check the network of doctors and hospitals. Ensure your preferred healthcare providers are included. An out-of-network provider can lead to higher costs. Having a plan that includes your doctors ensures you get the care you trust.

Lastly, review the plan’s customer service and support. Good customer service can make managing your health plan easier. Look for plans with positive reviews and strong support systems. This can be crucial when you need help with claims or questions.

Top Health Insurance Providers

Finding the best health insurance on the market can be challenging. Top providers like Blue Cross Blue Shield and UnitedHealthcare offer comprehensive coverage and reliable services.

When it comes to securing your health and well-being, choosing the right health insurance provider is crucial. With so many options available, it can be challenging to determine which company offers the best coverage, customer service, and value for money. In this section, we will delve into the top health insurance providers on the market, comparing their services and highlighting what makes each one stand out.

Overview Of Leading Companies

Several health insurance providers have earned a reputation for delivering excellent coverage and customer service. These companies often lead the market due to their comprehensive plans, extensive network of healthcare providers, and innovative solutions. Here are some of the top contenders: – UnitedHealthcare: Known for its large network and extensive coverage options. – Blue Cross Blue Shield: Offers robust plans and a wide array of provider options. – Kaiser Permanente: Integrates healthcare services with insurance for streamlined care. – Aetna: Provides flexible plans with a focus on preventative care. – Cigna: Offers global coverage and a variety of wellness programs.

Comparison Of Services

To help you make an informed decision, let’s compare the services offered by these leading health insurance providers:

| Provider | Coverage Options | Network Size | Customer Service | Special Features |

|---|---|---|---|---|

| UnitedHealthcare | Extensive | Very Large | 24/7 Support | Virtual Visits |

| Blue Cross Blue Shield | Robust | Wide Array | Highly Rated | Health Management Programs |

| Kaiser Permanente | Integrated | Large | Excellent | Coordinated Care |

| Aetna | Flexible | Large | Responsive | Preventative Focus |

| Cigna | Global | Extensive | Reliable | Wellness Programs |

Each of these providers offers unique advantages, catering to different needs and preferences. For instance, if you value having access to a wide range of healthcare providers, UnitedHealthcare and Blue Cross Blue Shield might be your best bet. On the other hand, if integrated care and preventative services are your priority, Kaiser Permanente and Aetna could be more suitable. Do you prioritize customer service and ease of access to health management tools? If so, consider how each provider ranks in these areas. UnitedHealthcare’s 24/7 support and Blue Cross Blue Shield’s health management programs are particularly noteworthy. Are you someone who travels frequently? Cigna’s global coverage can give you peace of mind, ensuring you’re protected no matter where you are. In my personal experience, choosing a provider with robust preventative care has made a significant difference in my overall health. Regular check-ups and wellness programs have helped me stay proactive about my health, catching potential issues early and avoiding costly treatments down the line. What specific aspects of health insurance do you find most important? Coverage options, network size, customer service, special features—these are all critical factors to consider. Ultimately, the best health insurance provider for you will depend on your individual needs and preferences. Take the time to compare these leading companies, and choose the one that aligns with your health goals and lifestyle.

Plan 1: Provider A

Choosing the best health insurance can be challenging. Plan 1 from Provider A stands out for its comprehensive coverage and reasonable costs. This plan offers various options tailored to individual needs.

Coverage Options

Provider A’s Plan 1 includes a wide range of coverage. It covers hospital stays, doctor visits, and emergency care. Preventive services like vaccinations and screenings are also included. Mental health support is part of the plan too. This plan ensures you get the care you need.

Cost And Benefits

Plan 1 from Provider A offers competitive pricing. Monthly premiums are affordable. There are low out-of-pocket costs for services. You save money while getting top-notch care. Provider A also has a large network of doctors and hospitals. This means you have many choices for your healthcare.

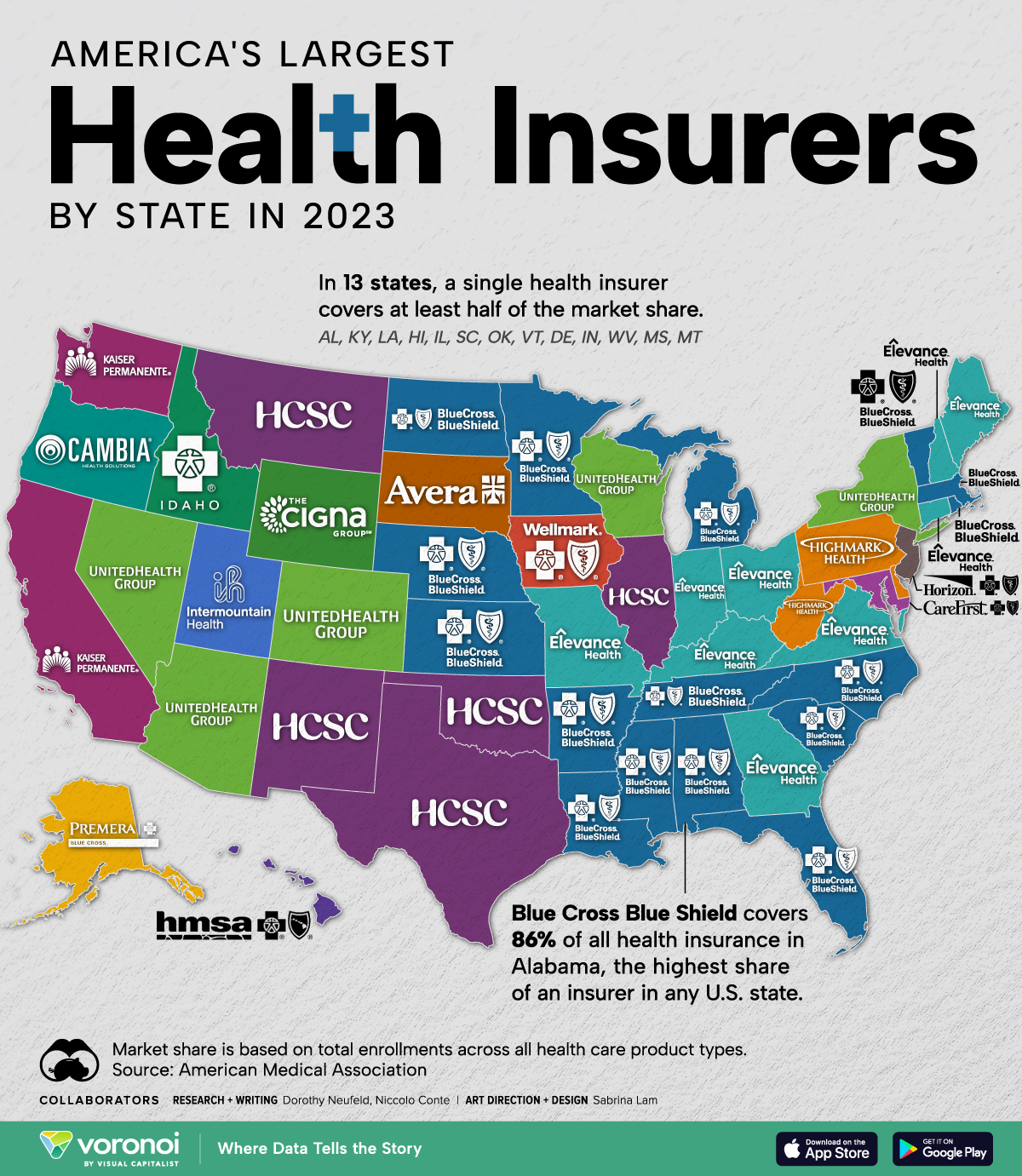

Credit: www.visualcapitalist.com

Plan 2: Provider B

When it comes to choosing the best health insurance on the market, Plan 2 from Provider B stands out for several reasons. I remember feeling overwhelmed while searching for health insurance options, but discovering Plan 2 provided much-needed clarity. This plan offers comprehensive coverage, balanced costs, and significant benefits that make it a compelling choice for many individuals and families. Let’s dive deeper into what makes Plan 2 from Provider B a top contender.

Coverage Options

Plan 2 from Provider B offers a broad range of coverage options tailored to various health needs. Whether you require regular check-ups, specialized treatments, or emergency care, this plan has you covered. It includes:

- Preventive services like annual physical exams and vaccinations

- Access to a wide network of specialists without needing referrals

- Comprehensive maternity and newborn care

- Mental health services, including therapy and counseling

- Prescription drug coverage for both generic and brand-name medications

These coverage options ensure that you and your family can receive the necessary care without any hassle. Have you ever had to skip an important medical appointment due to insurance issues? With Plan 2, those worries are minimized.

Cost And Benefits

One of the most crucial factors in selecting health insurance is the cost and the benefits you receive. Plan 2 from Provider B strikes a fine balance between affordability and comprehensive care. Here’s what you can expect:

| Cost | Benefits |

|---|---|

| Reasonable premiums | Low out-of-pocket maximums |

| Competitive deductibles | 80% coverage of medical expenses after deductible |

| Affordable co-pays | Free preventive care services |

While evaluating health insurance options, it’s essential to consider how much you’ll pay versus what you’ll gain. With Provider B’s Plan 2, you get a great value for your money. The low out-of-pocket maximums mean fewer unexpected expenses, which is a relief when managing your budget. How often do you find yourself worrying about surprise medical bills? This plan can help ease those concerns.

In conclusion, Plan 2 from Provider B is a strong contender in the health insurance market. Its extensive coverage options and balanced costs and benefits make it an attractive choice for many. If you are seeking a reliable and comprehensive health insurance plan, give Provider B’s Plan 2 a closer look. You might find it’s the perfect fit for your healthcare needs.

Plan 3: Provider C

Health insurance is crucial for peace of mind. Plan 3 from Provider C stands out. It offers comprehensive coverage and affordable costs. Let’s delve deeper into its features.

Coverage Options

Provider C’s Plan 3 covers a wide range of medical services. You get inpatient and outpatient care. Emergency services are included. Prescription drugs and preventive care are also covered. Mental health services receive significant attention. This plan offers coverage for therapy and counseling.

Cost And Benefits

Plan 3 is budget-friendly. Monthly premiums are reasonable. Deductibles are low, making healthcare affordable. You get value for your money. The benefits include a vast network of healthcare providers. You can choose from numerous specialists. The plan also includes wellness programs. This helps maintain a healthy lifestyle. Provider C’s Plan 3 ensures you get the care you need at a price you can afford.

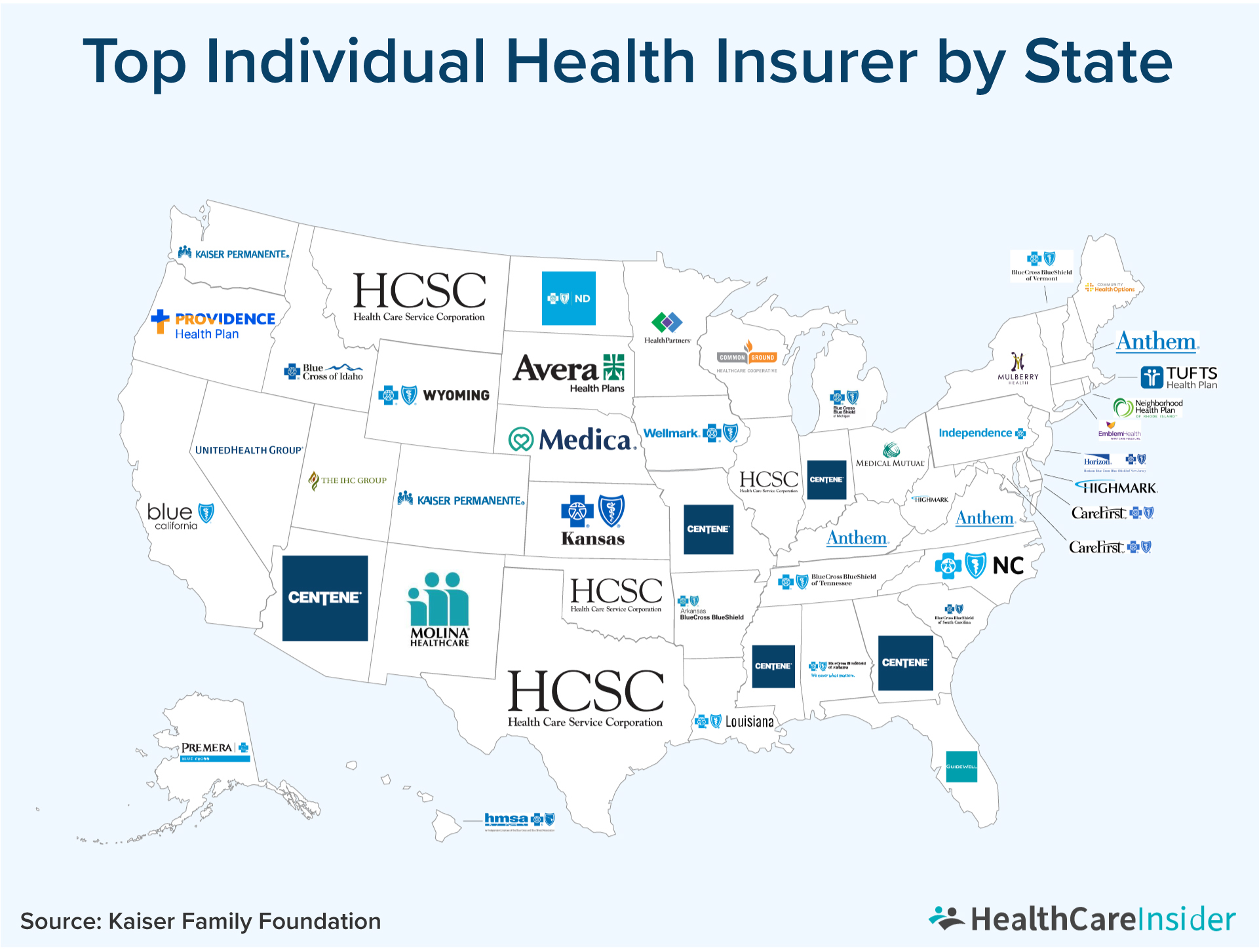

Credit: healthcareinsider.com

Plan 4: Provider D

Choosing the right health insurance can be challenging. Plan 4: Provider D stands out as one of the best options on the market. It offers comprehensive coverage and affordable costs. Let’s dive into the details.

Coverage Options

Plan 4: Provider D provides extensive coverage. It includes hospital stays, surgeries, and emergency care. Also, it covers preventive services like vaccinations and screenings. Mental health services are part of the plan. This makes it a complete package for your health needs.

Cost And Benefits

Plan 4: Provider D is cost-effective. Monthly premiums are affordable for many. The plan offers low deductibles and co-pays. It provides significant financial relief during medical emergencies. Users appreciate the wide network of doctors and hospitals. This access ensures you get the best care without extra costs.

Plan 5: Provider E

Provider E offers comprehensive coverage under Plan 5. This health insurance plan stands out for its affordable premiums and extensive network of healthcare providers. Ideal for individuals seeking reliable and cost-effective health care options.

When it comes to choosing the best health insurance on the market, Plan 5: Provider E stands out for its comprehensive offerings and customer-centric approach. This plan has been lauded for its extensive coverage options, reasonable costs, and numerous benefits. Whether you are looking for a plan that covers routine check-ups or something more extensive, Provider E has you covered.

Coverage Options

Provider E offers a wide range of coverage options designed to meet diverse healthcare needs. From preventive care to specialized treatments, the plan ensures you have access to the medical services you require. – Preventive Care: Routine check-ups, vaccinations, and screenings are all covered, encouraging you to stay on top of your health. – Specialized Treatments: If you need specialist care, Provider E includes options for mental health services, physical therapy, and even alternative treatments like acupuncture. – Emergency Services: In the event of an emergency, you’re covered whether you’re at home or traveling abroad. A personal experience with Provider E’s coverage options showed me just how comprehensive it is. When my friend had an unexpected surgery, the plan covered almost all the costs, including follow-up appointments. It was a relief to see how smoothly everything was handled.

Cost And Benefits

Understanding the cost and benefits of a health plan is crucial. Provider E offers competitive pricing without compromising on the quality of care. – Affordable Premiums: The monthly premiums are budget-friendly, making it easier for families and individuals to maintain coverage. – Low Co-Pays: With lower co-pays for doctor visits and prescriptions, you won’t be shelling out a lot each time you need care. – Annual Deductible: The deductible is manageable, ensuring that you do not have to break the bank before your insurance kicks in. – Extra Perks: Additional benefits include wellness programs, discounts on gym memberships, and access to a 24/7 nurse hotline. Have you ever wondered if a health insurance plan can actually save you money? With Provider E, the answer is yes. By taking advantage of the wellness programs and preventive care, you can avoid costly treatments down the line. Choosing a health insurance plan is a significant decision. Provider E’s Plan 5 offers the coverage you need at a price that won’t strain your budget. Consider what matters most to you in a health plan and see if Provider E meets those needs. How does your current plan compare? Is it time for a change? By focusing on your unique needs and providing clear, practical options, Provider E makes it easier to stay healthy and financially secure.

Credit: www.valuepenguin.com

How To Choose The Best Plan

Choosing the best health insurance plan can be daunting. With numerous options available, it’s essential to find a plan that meets your needs. Let’s break down the process into simple steps.

Assessing Personal Needs

Start by evaluating your health requirements. Consider your current health status. Do you need regular check-ups or have a chronic condition? Make a list of doctors and medical services you frequently use. This helps in identifying a plan that covers your needs.

Also, think about future health needs. Are you planning to expand your family? Anticipate potential health issues. This ensures you choose a plan that supports your long-term health goals.

Evaluating Financial Factors

Next, examine your budget. Look at the monthly premiums, but don’t stop there. Consider other costs like deductibles, copayments, and out-of-pocket maximums. These expenses add up and impact your budget.

Check if your preferred doctors and hospitals are in-network. Out-of-network care can be expensive. Make sure the plan covers the medications you take. High prescription costs can strain your finances.

Remember, the cheapest plan isn’t always the best. Balance cost with coverage. Ensure the plan offers good value for your money.

Frequently Asked Questions

What Is The Best Health Insurance Company To Go With?

The best health insurance company varies based on individual needs. Popular options include UnitedHealthcare, Blue Cross Blue Shield, Aetna, and Cigna. Research and compare plans to find the best fit.

Who Is The Number 1 Health Insurance In The Us?

UnitedHealth Group ranks as the number 1 health insurance provider in the US, offering extensive coverage and services.

What Is The Most Rated Health Insurance?

Blue Cross Blue Shield is the most rated health insurance. It offers comprehensive coverage and has high customer satisfaction ratings.

Which Health Insurance Company Denies The Most Claims?

Health insurance claim denial rates vary annually. Research indicates Aetna has had high denial rates in recent years. Always check current reviews and reports.

Conclusion

Choosing the best health insurance takes careful research. Each plan has unique benefits. Understand your needs first. Compare different options available. Look at costs, coverage, and network providers. The right insurance offers peace of mind. Make an informed decision to protect your health and finances.

Stay healthy and insured.